In its first budget, the new Government of Prime Minister David Cameron has eased markedly its intended austerity measures that had been pencilled in by the previous Coalition. However, the new relatively less intense tightening is still financed by welfare cuts, net tax increases and three years of higher government borrowing. Chancellor Osborn has delayed the expected return to a budget surplus by a year to 2019-20, sugar coating this delay by promising a slightly bigger surplus in the medium term. Chancellor’s introduction, from April next year, of a £7.20 an hour National Living Wage, rising to £9 an hour by 2020 outshone the opposition’s election pledge for an £8/hour minimum wage by 2020.

Does this budget change the trajectory of the British economy towards a more dynamic and competitive path? To explore this question let’s have a look at the current state of the economy. The UK independent Office for Budget Responsibility, OBR’s estimate of the margin of spare capacity in the economy is 0.6 per cent of potential output in 2015-16 and OBR expects this ‘output gap’ to close in 2018-19. However, these estimates may be hiding the fact that because of businesses’ utilization of contingent capacity the gap has been underestimated. This is because in planning for capacity during uncertain times businesses usually postpone their irreversible component of investment and utilize intensive margin production processes. As a result of this focus on short-term capacity corresponding to existing cost structure the longer-term capacity signals will be hidden. This reading is validated by the Bank of England’s August Inflation Report that reports:

The chart below, based on the OECD data, shows the widening gap in capital formation between the UK and the United states, particularly since the recent big recession which can explain why productivity growth in Britain has been so low.

As the following chart shows, ONB predicts that investment as a share of GDP, which was hovering around 11% in recent quarters will increase to about 13% by 2018. However, the latest data show that business investment growth slowed in the second half of 2014, thus in a backdrop of heightened uncertainty the ONB predication may prove rather optimistic. Nevertheless, even if its prediction comes to pass the amount of investment would not be sufficient to remedy the loss of competitiveness of British industries, which are in need of a drastic restructuring in response to the imperatives of the new technological advances such as in internet of things, mobility, 3-D technologies, and smart raw materials, to name a few.

Moreover, the Bank of England’s Agents’ Summary, depicted in the following chart, indicates only moderate investment growth and it is not clear as to whether the new investment would be aiming at expanding the production frontier and increased competitiveness or will still be focused on a tactical reversible investment, such as repair and marginal upgrading of the existing technology along pursuing a path of intensive margin production process.

As already mentioned such moderate investment growth would not be sufficient for the needed restructuring and the crucially necessary enhancement of British competitiveness. The chancellor’s strategy to rejuvenate manufacturing and exports by new trade deals cannot succeed in the absence of investment that would be geared toward enhancing competitiveness. His fast-track visa system for wealthy Chinese investors would be ineffective, if the new investments just move towards real estate instead of new technology. In order to halt the persistent decline of the UK export market share, depicted in the following chart, a significant rise in investment would be prerequisite.

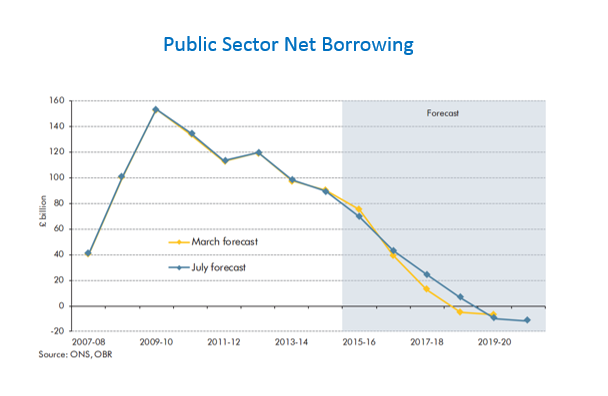

A participation in the current currency war, even when British pound has appreciated 20% on a trade-weighted basis since March 2013, would not be an option. As it would either worsen the public sector net borrowing (depicted in the chart below), or further reduce the effectiveness of monetary policy, and exacerbating household high level of debt (the next chart below). Of course, one needs to be reminded that that the Bank of England has maintained the stock of purchased assets financed by the issuance of central bank reserves at £375 billion, and will reinvest the £16.9 billion of cash flows associated with the redemption of the September 2015 gilt held in the Asset Purchase Facility. At the same time the Government’s spending is expected to be £83.3 billion higher in total over the current Parliament relative to the previous Coalition budget. Thus, more easing will add to the distorting imbalances.

Does this budget change the trajectory of the British economy towards a more dynamic and competitive path? To explore this question let’s have a look at the current state of the economy. The UK independent Office for Budget Responsibility, OBR’s estimate of the margin of spare capacity in the economy is 0.6 per cent of potential output in 2015-16 and OBR expects this ‘output gap’ to close in 2018-19. However, these estimates may be hiding the fact that because of businesses’ utilization of contingent capacity the gap has been underestimated. This is because in planning for capacity during uncertain times businesses usually postpone their irreversible component of investment and utilize intensive margin production processes. As a result of this focus on short-term capacity corresponding to existing cost structure the longer-term capacity signals will be hidden. This reading is validated by the Bank of England’s August Inflation Report that reports:

Companies using their existing capital and labour more intensively will increase measured productivity but there is a limit to how far companies can do this without putting excessive upward pressure on their costs. Survey measures suggest that, having increased since 2013, capacity utilisation picked up a little in 2015 Q2, and is close to or perhaps slightly above past average levels.Consistent with Ben Bernanke’s option price of waiting it would be quite rational for businesses to postpone their strategic investment plans at times of currency wars and global volatility, and focus instead on their contingent capacity limits. Thus, business surveys instead of picking up reports of capacity utilization rates relative to the long term capacity associated with the firm’s minimum long-term average costs would detect signals of capacity tightening due to delays in implementation of irreversible phases of investment. This observation can also be validated by indicators such as investment profile and productivity growth. Note that productivity growth — defined as the rate of change of output minus rate of change of hour worked — will rise when investors invest to expand the production possibility frontier which usually would reduce their cost structure through adoption of new innovative technologies. The fact that growth in the UK productivity has been subdued in the past eight years is a clear indication that British investors are still quite hesitant to invest strategically to enhance competitiveness.

The chart below, based on the OECD data, shows the widening gap in capital formation between the UK and the United states, particularly since the recent big recession which can explain why productivity growth in Britain has been so low.

As the following chart shows, ONB predicts that investment as a share of GDP, which was hovering around 11% in recent quarters will increase to about 13% by 2018. However, the latest data show that business investment growth slowed in the second half of 2014, thus in a backdrop of heightened uncertainty the ONB predication may prove rather optimistic. Nevertheless, even if its prediction comes to pass the amount of investment would not be sufficient to remedy the loss of competitiveness of British industries, which are in need of a drastic restructuring in response to the imperatives of the new technological advances such as in internet of things, mobility, 3-D technologies, and smart raw materials, to name a few.

Moreover, the Bank of England’s Agents’ Summary, depicted in the following chart, indicates only moderate investment growth and it is not clear as to whether the new investment would be aiming at expanding the production frontier and increased competitiveness or will still be focused on a tactical reversible investment, such as repair and marginal upgrading of the existing technology along pursuing a path of intensive margin production process.

As already mentioned such moderate investment growth would not be sufficient for the needed restructuring and the crucially necessary enhancement of British competitiveness. The chancellor’s strategy to rejuvenate manufacturing and exports by new trade deals cannot succeed in the absence of investment that would be geared toward enhancing competitiveness. His fast-track visa system for wealthy Chinese investors would be ineffective, if the new investments just move towards real estate instead of new technology. In order to halt the persistent decline of the UK export market share, depicted in the following chart, a significant rise in investment would be prerequisite.

A participation in the current currency war, even when British pound has appreciated 20% on a trade-weighted basis since March 2013, would not be an option. As it would either worsen the public sector net borrowing (depicted in the chart below), or further reduce the effectiveness of monetary policy, and exacerbating household high level of debt (the next chart below). Of course, one needs to be reminded that that the Bank of England has maintained the stock of purchased assets financed by the issuance of central bank reserves at £375 billion, and will reinvest the £16.9 billion of cash flows associated with the redemption of the September 2015 gilt held in the Asset Purchase Facility. At the same time the Government’s spending is expected to be £83.3 billion higher in total over the current Parliament relative to the previous Coalition budget. Thus, more easing will add to the distorting imbalances.

No comments:

Post a Comment